AI is transforming wealth management from intuition-based advising to algorithm-driven precision. In 2025, AI-powered solutions are delivering hyper-personalized portfolios, 24/7 insights, and emotion-free decision-making. With the global WealthTech market projected to hit $137 billion by 2028 (Fortune Business Insights), ignoring this shift is like using paper maps in a GPS world.

What Is Wealthtech, and Why 2025 Is a Turning Point

Think of traditional investing like navigating with a compass. Now, imagine switching to an autonomous vehicle that anticipates roadblocks, learns your destination preferences, and recalibrates in real time. That’s AI in WealthTech.

In 2025, the rise of AI-powered advisors is reshaping how people invest, moving from manual portfolio rebalancing and gut-driven decisions to real-time, data-backed guidance tailored to every investor’s goals and risk appetite. These advisors don’t sleep, don’t second-guess, and don’t get swayed by headlines.

Consider this: AI-enabled portfolio management is expected to grow at a 25.7% CAGR from 2021 to 2028, and platforms like Betterment and Wealthfront already manage over $40 billion in combined assets (Statista, Deloitte). This isn’t just tech adoption, it’s a revolution in financial behavior.

So what does this mean for investors, wealth managers, and financial institutions clinging to old models? It’s time to rethink the role of trust, transparency, and technology in wealth management, or risk being left behind.

The Rise of AI-Powered Financial Advisors

What once sounded like science fiction, an AI managing your investments is now a daily reality. In 2025, AI-powered advisors are no longer limited to backend analysis. They’re helping investors make smarter decisions, faster.

These digital advisors don’t sleep, don’t get emotional, and don’t forget compliance rules. They analyze millions of data points in real time to offer personalized investment strategies, rebalance portfolios on the fly, and adapt to market shifts instantly. Platforms like Wealthfront, Betterment, and SigFig are leading this AI-first shift, managing billions in assets without a single human whispering “buy low, sell high.”

And the appeal isn’t just for tech-savvy Gen Z investors. Even high-net-worth individuals and large institutions are turning to AI for its speed, accuracy, and ability to detect risks before human advisors even notice them.

The result? A massive redefinition of what it means to “trust your advisor”, because increasingly, that advisor isn’t a person.

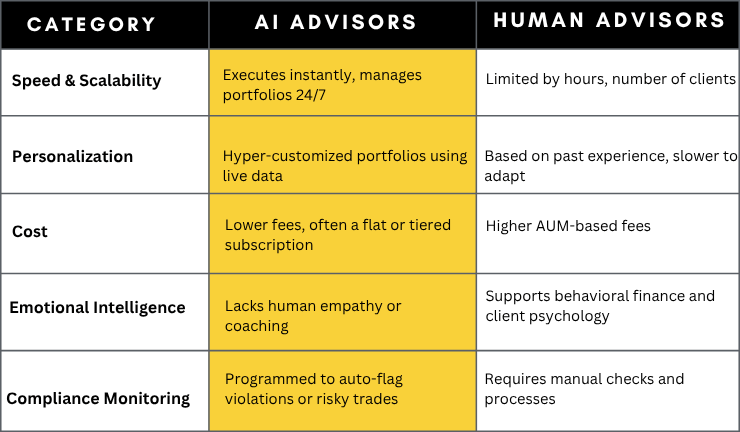

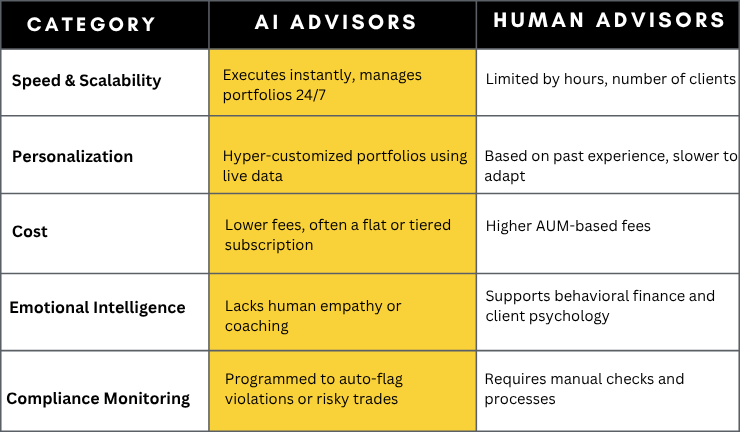

AI vs Traditional Financial Advisors: Who Wins Where in 2025?

Human advisors bring intuition, empathy, and relationship-building. AI brings real-time data, logic, and scale. So, who wins? In 2025, the answer isn’t either/or, it’s about knowing where each excels.

Benefits of AI in Wealth Management

A. Real-Time Portfolio Rebalancing

Gone are the days of quarterly check-ins. AI platforms monitor market shifts, investor behavior, and macroeconomic trends in real time, adjusting allocations instantly to stay aligned with risk profiles.

This means portfolios stay optimized even during volatile market conditions, reducing reaction time and maximizing performance.

B. Personalized Investment Strategies

Using behavioral data, transaction history, and even sentiment analysis, AI builds strategies as unique as the investor. This hyper-personalization is nearly impossible to achieve manually at scale.

AI can tailor portfolios not just to goals and risk appetite, but to changing life stages, spending habits, and evolving market dynamics.

C. Enhanced Risk Management

AI can simulate thousands of scenarios to anticipate and mitigate downside risk, before it becomes a headline. It flags patterns human eyes might miss, from liquidity crunches to sector volatility.

By continuously learning from market data, AI helps advisors and investors proactively adjust strategies instead of reacting to losses.

D. 24/7 Availability and Lower Costs

AI advisors don’t sleep. Investors can get portfolio insights, make trades, or update preferences anytime, without waiting for an advisor’s availability. Bonus: fewer overheads mean lower fees.

This democratizes access to sophisticated financial advice, making quality investment tools available even to retail investors with modest portfolios.

E. Bias-Free Decision Making

AI isn’t swayed by panic, market noise, or confirmation bias. It makes cold, calculated moves based on logic and data, something even seasoned advisors struggle with in high-stress environments. This eliminates emotional decision-making and ensures long-term discipline, especially during turbulent economic cycles.

Top 5 AI-Powered WealthTech Tools Leading the Charge in 2025

AI is no longer an emerging feature in wealth management, it’s the engine powering many of the most trusted platforms in the industry. These five tools are redefining how investors make decisions, manage risk, and grow wealth.

1. Wealthfront

Wealthfront offers fully automated investing with AI-driven financial planning, rebalancing, and tax optimization. It adapts to user goals in real time, making it ideal for hands-off investors seeking smart, long-term growth.

2. Betterment

Betterment blends AI with access to human advisors, offering a personalized yet scalable experience. Its algorithms handle portfolio management, while tools like SmartDeposit and goal-based planning make it user-friendly and effective.

3. SigFig

SigFig provides data-driven investment recommendations and portfolio management for both individual investors and large institutions. Its AI platform also supports white-label solutions for financial firms, helping them modernize their client experience.

4. Zeni

Zeni acts as an AI-powered finance team for startups and small businesses. It automates bookkeeping, forecasting, and reporting, giving founders real-time insights without needing a full finance department.

5. Magnifi

Magnifi functions like a financial search engine powered by conversational AI. Investors can ask natural language questions and receive real-time investment recommendations based on their preferences and risk appetite.

Challenges Ahead and Why Hybrid WealthTech Models Are the Future

While AI-powered advisors offer speed, scale, and personalization, they also come with serious challenges that the industry can’t afford to ignore. Trust remains a major hurdle, many investors are still hesitant to let a machine make decisions about their money. The lack of transparency in AI decision-making, potential biases in training data, and increasing concerns around data privacy have made regulators, and users more cautious.

There’s also the question of empathy and context. AI can process data, but it can’t yet fully understand emotional nuance, life complexities, or behavioral triggers that affect investor decisions. That’s where human advisors still hold the edge.

The solution isn’t to choose between humans and machines. It’s to combine them.

Hybrid advisory models are emerging as the most effective way forward. In this setup, AI handles the heavy lifting, analyzing data, managing portfolios, and delivering real-time alerts, while human advisors provide strategic guidance, emotional reassurance, and context-driven advice. Together, they create an experience that is both intelligent and trustworthy.

But building a hybrid wealthtech solution that works seamlessly takes more than plugging in an algorithm.

Where ISHIR Fits In: Turning Intelligence Into Advantage

ISHIR’s Data & Analytics services are designed to help fintech and wealth management firms unlock the full potential of AI, ethically, securely, and strategically. Whether you’re building a robo-advisor, enhancing an existing investment platform, or designing a data-driven personalization engine, we bring the engineering power and domain expertise to make it real.

From modern data architecture and ML model development to real-time analytics dashboards and predictive insights, we help you turn raw financial data into actionable intelligence. And we do it with transparency, compliance, and scale in mind, so your platform grows, earns trust, and delivers consistent value.

The future of wealth management isn’t human or AI. It’s both. And with ISHIR, you don’t just catch the wave, you engineer it.

Struggling to turn complex financial data into smart investment decisions?

ISHIR’s Data & Analytics services help you build AI-powered wealthtech solutions that are fast, secure, and future-ready.

The post Wealthtech in 2025: How AI-Powered Advisors Are Changing the Investment Game appeared first on ISHIR | Software Development India.